43+ limitations on mortgage interest deduction

Web Up to 96 cash back You can fully deduct home mortgage interest you pay on acquisition debt if the debt isnt more than these at any time in the year. Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly.

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

. An estimated 137 percent of filers itemized in. Under Tax Cut and Jobs Act for tax years. There is an overall.

Look in your mailbox for Form 1098. Ad Access Tax Forms. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

Web Essentially you may be able to deduct the interest of up to 100000 of the debt as well as 130th of the points each year assuming its a 30-year mortgage. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. Web Beginning in 2018 this limit is lowered to 750000.

If you took out. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Register and Subscribe Now to Work on Pub 936 More Fillable Forms.

Discover Helpful Information And Resources On Taxes From AARP. Web Important rules and exceptions. Web How to claim the mortgage interest deduction.

Lets start with the mortgage from 2016 with an average balance of. Web Most homeowners can deduct all of their mortgage interest. Web Yes of course.

Web How to use equity in your home and bypass the 750K Mortgage Interest Limitation Heres whats happening. Web The home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of their loan. The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately.

Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Your mortgage lender sends you a Form 1098 in January or early February. For tax year 2022 those amounts are rising to.

Here is a simplified example with two instead of three mortgages. Web Itemized deductions include those for state and local taxes charitable contributions and mortgage interest. Your deduction is limited to all mortgages used to buy construct or improve your first and second home.

750000 if the loan was finalized. Web Under the Tax Cuts and Jobs Act TCJA the interest is deductible on acquisition debt up to a 750000 threshold for 2018 through 2025 down from 1 million. Web The old rules allowed you to deduct interest on an added 100000 of the loan or 50000 each for married couples filing separate returns.

Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and. Complete Edit or Print Tax Forms Instantly.

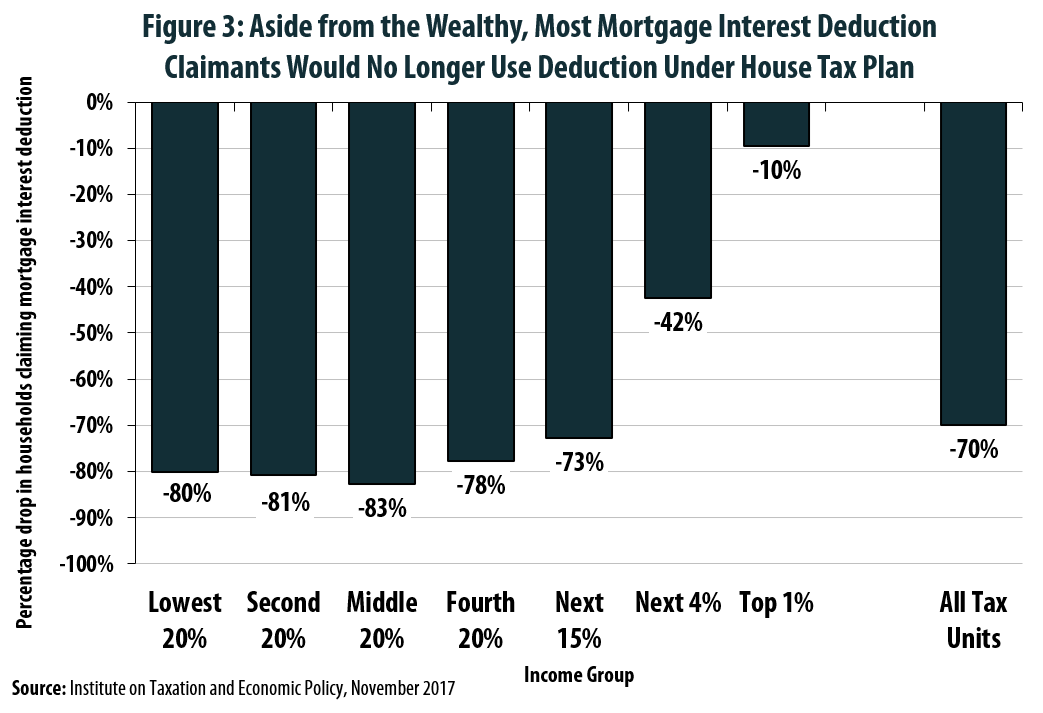

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Mortgage Interest Deduction A Guide Rocket Mortgage

Mortgage Interest Deduction Faqs Jeremy Kisner

Gutting The Mortgage Interest Deduction Tax Policy Center

Mortgage Interest Deduction Faqs Jeremy Kisner

Mortgage Interest Deduction Rules Limits For 2023

Mortgage Interest Deduction Faqs Jeremy Kisner

It S Time To Gut The Mortgage Interest Deduction

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

The History And Possible Future Of The Mortgage Interest Deduction

New Mortgage Interest Deduction Rules Evergreen Small Business

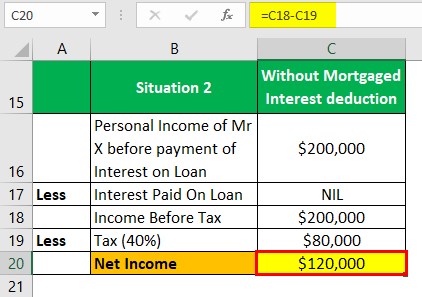

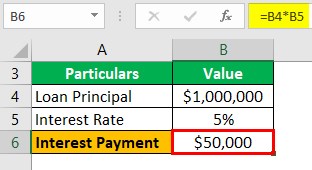

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Deduction Can Be Complicated Here S What You Need To Know For The 2022 Tax Season The Seattle Times

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Deduction A 2022 Guide Credible

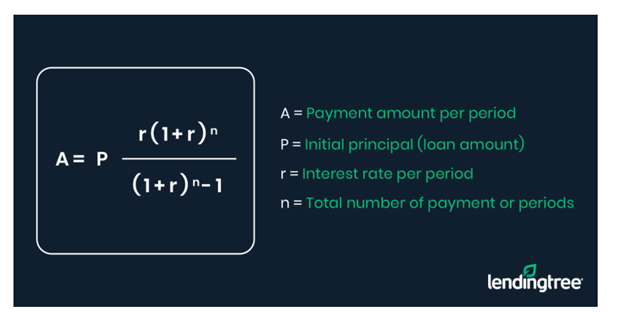

The Home Mortgage Interest Deduction Lendingtree

Debunking 3 Myths About The Mortgage Interest Deduction