Simple mortgage calculator formula

See How Finance Works for the mortgage formula. If you have 100 and the simple interest rate is 10 for two years you will have 102100 20 as interest.

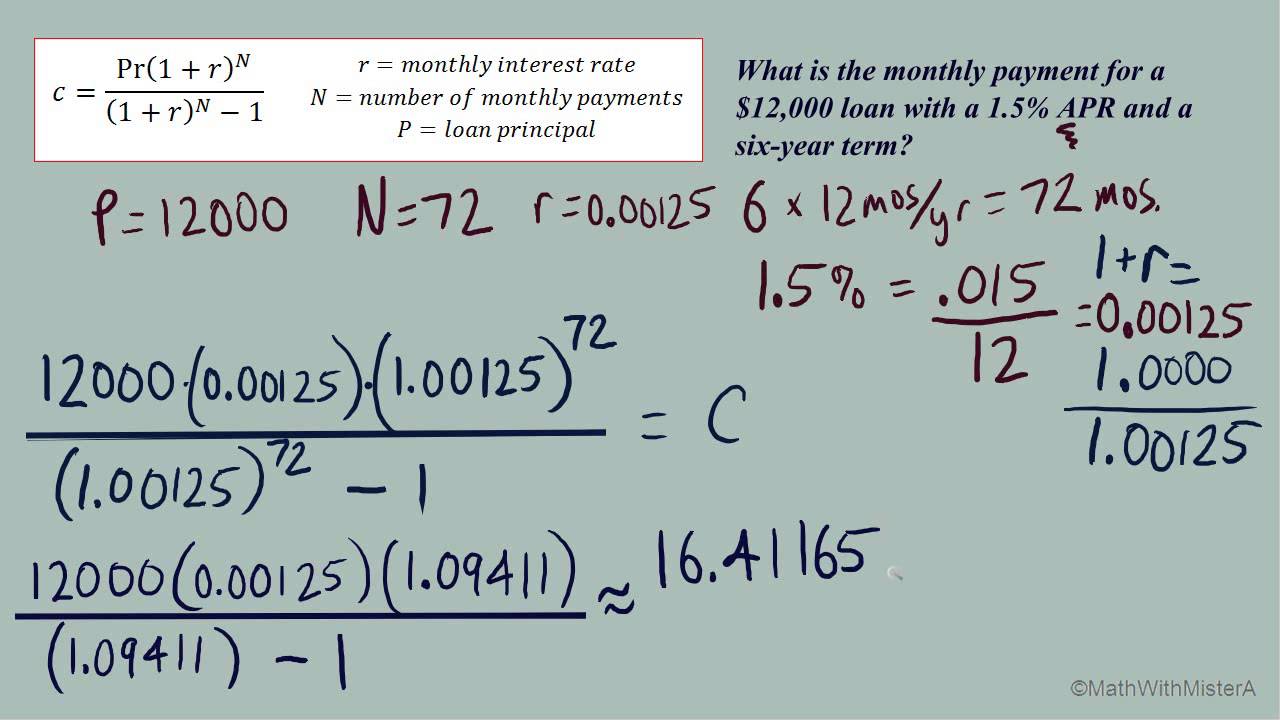

How To Calculate Your Monthly Mortgage Payment Given The Principal Interest Rate Loan Period Youtube

This is the best option if you are in a rush andor only plan on using the calculator today.

. In simple interest you earn interest on the same principal for the investment term and you lose out on income that you can earn on that additional amount. The BMI formula uses your weight in kg or pounds and your height in meters or inches to form a simple calculation that provides a measure of your body fat. To calculate the monthly payment with PMT you must provide an interest rate the number of periods and a present value which is the loan.

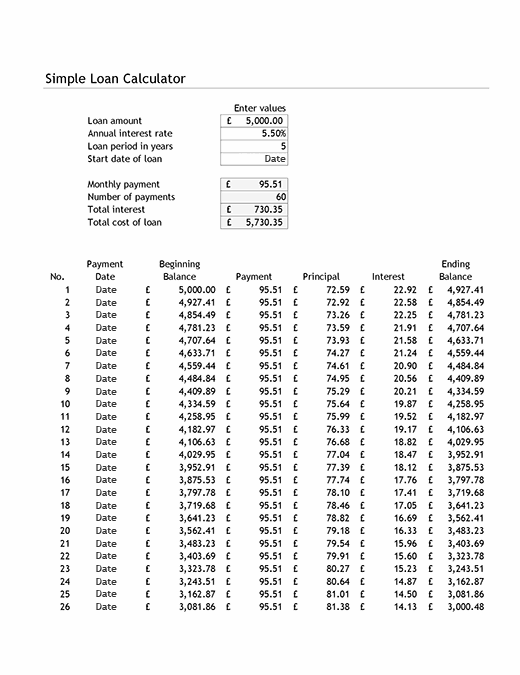

Amortization Formula in Excel With Excel Template Amortization Formula. The calculator will help you easily see that despite the higher interest rate the 15-year loan is a cheaper option. In addition to this simple loan payment calculator we also offer tools for helping you determine your monthly mortgage auto and debt consolidation payments.

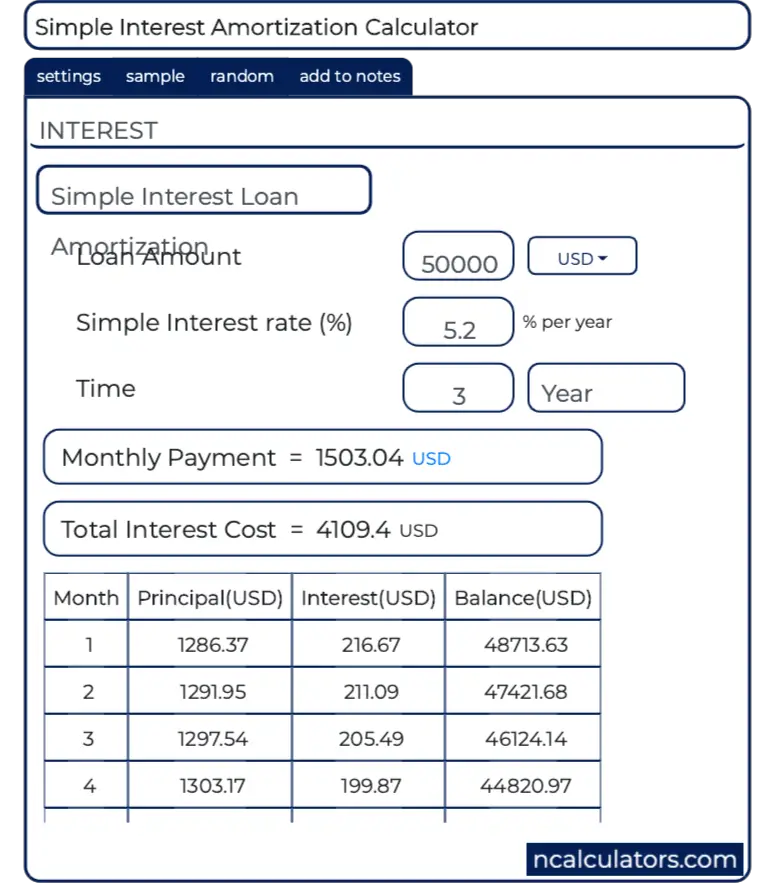

Firstly though you must make sure to include all of your obligations. This is the formula the calculator uses to determine simple daily interest. Our simple interest calculator calculates monthly payments on an interest-only loanJust provide the interest percentage and youll know how much that loan costs.

A mortgage is an example of an annuity. Its as simple as taking the total sum of all your monthly debt payments and dividing that figure by your total monthly income. Mortgage Calculator zip file - download the zip file extract it and install it on your computer.

Amortization refers to paying off debt amount on periodically over time till loan principle reduces to zero. Amortization Formula Table of Contents Amortization Formula. Brets mortgageloan amortization schedule calculator.

An annuity is a series of equal cash flows spaced equally in time. Calculate loan payment payoff time balloon interest rate even negative amortizations. This can also be a useful way to compare mortgage plans.

A program of the Bureau of the Fiscal Service. For example you may be deciding between a 15-year loan at 6 percent or a 30-year loan at 4 percent. This calculator shows your monthly payment on a mortgage.

Now the charges annual interest rate of 12 and the loan has to be repaid over a period of 10 years. Almost any data field on this form may be calculated. Enter the appropriate numbers in each slot leaving blank or zero the value that you wish to determine and then.

Years to Pay. Of periods n 10 12. The formula for BMI was devised in the 1830s by Belgian mathematician Adolphe Quetelet and is universally expressed in kgm 2.

Simple Interest Formulas and Calculations. On this page I explain the simple interest formula and provide a simple interest calculator that you can use to solve some basic problems. A P1 rt where P is the Principal amount of money to be invested at an Interest Rate R per period for t Number of Time Periods.

This function can be used to calculate the principal. Use this simple interest calculator to find A the Final Investment Value using the simple interest formula. Let us take the simple example of a loan for setting up a technology-based company and the loan is valued at 1000000.

We can calculate the equated monthly amount in excel using the PMT function Using The PMT Function The PPMT function in Excel is a financial function that calculates the payment for a given principal and returns an integer result. Compound Interest Present Value Return Rate CAGR Annuity Pres. D is the number of days for which interest is being calculated.

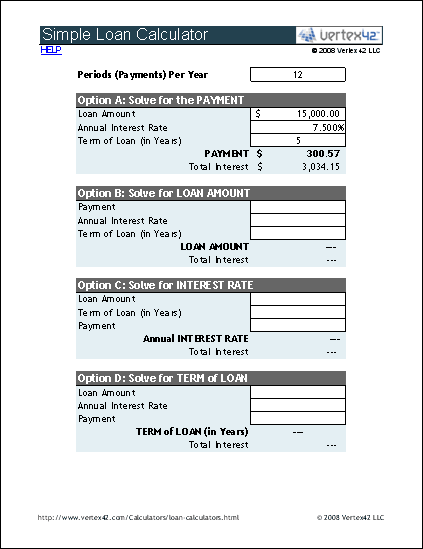

The PMT function calculates the required payment for an annuity based on fixed periodic payments and a constant interest rate. Unlike many of our other mortgage and loan calculators our Simple Loan Calculator uses just the basic built-in financial formulas to calculate either the payment using the PMT formula the interest rate using the RATE formula the. This is the best option if you plan on using the calculator many times over the.

Amount paid monthly is known as EMI which is equated monthly installment. The difference between just interest and mortgage payment is simple - with the mortgage calculator every month you repay a part of the principal and your loan balance gets lower and lower. Simple Interest means earning or paying interest only the Principal 1.

Mortgage Calculator exe file - click the link and immediately run the mortgage calculator. Other obligations and subscriptions. Pr360d P is the amount of principal or invoice amount.

The Principal is the amount borrowed the original amount invested or the face value of a bond 2. The frequency of payment. With links to articles for more information.

Of Annuity Bond Yield. R is the Prompt Payment interest rate. Using the above-mentioned mortgage formula calculate the fixed monthly payment.

Some loan calculations can be very simple and the purpose of the simple loan calculator spreadsheet below is to demonstrate this with Excel.

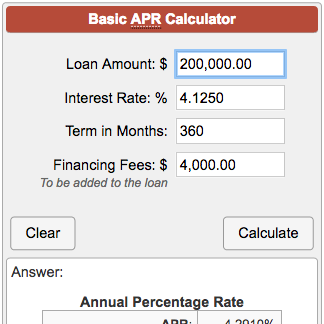

Basic Apr Calculator

Mortgage Calculator

Simple Mortgage Calculator Template Formidable Forms

Simple Interest Loan Calculator How It Works

Mortgage Payment Calculator Mortgage Calculator Using Microsoft Excel

Loan Calculator Free Simple Loan Calculator For Excel

Excel Formula Estimate Mortgage Payment Exceljet

Simple Loan Calculator

Extra Payment Mortgage Calculator For Excel

Simple Mortgage Calculator

Simple Interest Amortization Calculator

Download Microsoft Excel Simple Loan Calculator Spreadsheet Xlsx Excel Basic Loan Amortization Schedule Template

Mortgage Repayment Calculator

How To Calculate Monthly Mortgage Payment In Excel

![]()

Simple Interest Loan Calculator How It Works

Simple Loan Calculator And Amortisation Table

Mortgage Calculator Youtube